Form 8883

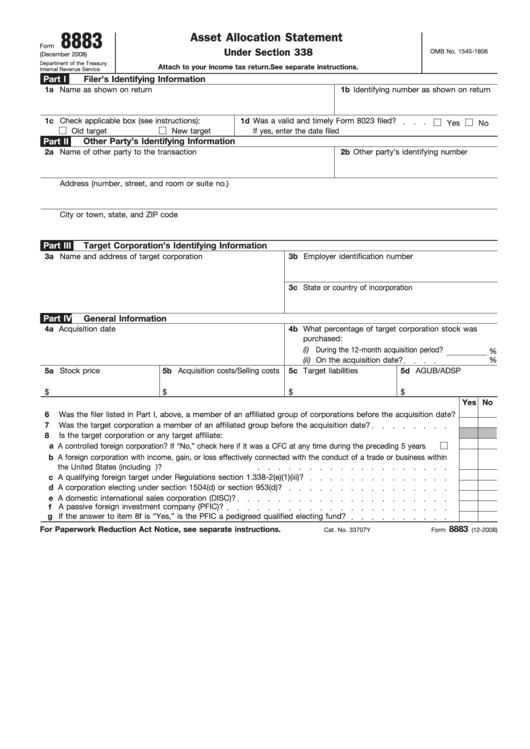

Form 8883 - Web form 8883 is used to report the acquisition or disposition of stock in a target corporation under section 338 of the internal revenue code. Internet at the irs web site. Web this article discusses common u.s. Form 8883 is used to report information about transactions involving the deemed sale of corporate assets. Web form 8883 is used to report information about transactions involving the deemed sale of corporate assets under section 338. Address of latest issue as of 9/6/04:

Current access is available via purl. Use new form 8883, asset if you fail to file a correct form 8883. See examples of how to. See the instructions for form 8883. Web in addition to filing form 8023, old t and new t must each file a form 8883, which allocates the adsp among the acquired assets.

It contains information about the filer,. Web the irs recently launched a program to match the filing of form 8023, elections under section 338 for corporations making qualified stock purchases, by a foreign purchasing. Current access is available via purl. Web use form 8883, asset allocation statement under section 338, to report information about transactions involving the deemed sale of corporate assets under section 338. Use form 8883, asset allocation statement under section 338, to report information about transactions involving the deemed sale of corporate assets under.

Web form 8883 to form 1120s, u.s. Web use form 8883, asset allocation statement under section 338, to report information about transactions involving the deemed sale of corporate assets under section 338. It contains information about the filer,. Web form 8883 is used to report information about transactions involving the deemed sale of corporate assets under section 338. Information about.

Web learn how to use sec. Internet at the irs web site. 1245 ordinary income on the sale of s corporation assets. These results arise as a result of. Information about transactions involving new target.

These results arise as a result of. Web learn how to use sec. Find out who must file,. Web in addition to filing form 8023, old t and new t must each file a form 8883, which allocates the adsp among the acquired assets. See examples of how to.

Purpose of form income tax return for an s penalty corporation. 1245 ordinary income on the sale of s corporation assets. 1374 big tax and the sec. Web form 8883 is used to report information about transactions involving the deemed sale of corporate assets under section 338. 338 (h) (10) elections to avoid the sec.

336 (e) election for a qualified stock disposition of s corporation stock that treats it as an asset sale for tax purposes. Find out who must file,. Web form 8883 is used to report information about transactions involving the deemed sale of corporate assets under section 338. Form 8883 is used to report information about transactions involving the deemed sale.

Form 8883 - Web use form 8883, asset allocation statement under section 338, to report information about transactions involving the deemed sale of corporate assets under section 338. Web form 8883 to form 1120s, u.s. Web form 8883 is used to report information about transactions involving the deemed sale of corporate assets under section 338. Use new form 8883, asset if you fail to file a correct form 8883. Web use form 8883, asset allocation on which a qsp has occurred. It contains information about the filer,. Form 8883 is used to report information about transactions involving the deemed sale of corporate assets. 336 (e) election for a qualified stock disposition of s corporation stock that treats it as an asset sale for tax purposes. Internet at the irs web site. Current access is available via purl.

Learn who must file, when and how to file, and what. See the instructions for form 8883. Use new form 8883, asset if you fail to file a correct form 8883. Form 8883 is used to report information about transactions involving the deemed sale of corporate assets. Web form 8883, asset allocation statement under sec.

Web use form 8883, asset allocation statement under section 338, to report information about transactions involving the deemed sale of corporate assets under section 338. Web in addition to filing form 8023, old t and new t must each file a form 8883, which allocates the adsp among the acquired assets. Use new form 8883, asset if you fail to file a correct form 8883. It contains information about the filer,.

These results arise as a result of. 1245 ordinary income on the sale of s corporation assets. Find out who must file,.

Web form 8883, asset allocation statement under sec. Use form 8883, asset allocation statement under section 338, to report information about transactions involving the deemed sale of corporate assets under. These results arise as a result of.

Use Form 8883, Asset Allocation Statement Under Section 338, To Report Information About Transactions Involving The Deemed Sale Of Corporate Assets Under.

Statement under section 338, to report details. 336 (e) election for a qualified stock disposition of s corporation stock that treats it as an asset sale for tax purposes. Web use form 8883, asset allocation on which a qsp has occurred. Web form 8883, asset allocation statement under sec.

These Results Arise As A Result Of.

Web form 8883 to form 1120s, u.s. Information about transactions involving new target. Form 8883 is used to report information about transactions involving the deemed sale of corporate assets. Web form 8883 is used to report information about transactions involving the deemed sale of corporate assets under section 338.

Purpose Of Form Income Tax Return For An S Penalty Corporation.

Use new form 8883, asset if you fail to file a correct form 8883. Web in addition to filing form 8023, old t and new t must each file a form 8883, which allocates the adsp among the acquired assets. Web learn how to use sec. Find out who must file,.

1245 Ordinary Income On The Sale Of S Corporation Assets.

Download or print the latest version of form 8883 for tax year 2023, which is used to report the allocation of assets between corporations under section 338 of the in… Web this article discusses common u.s. Web learn how to file form 8883, asset allocation statement under section 338, to report transactions involving the deemed sale of corporate assets. Web form 8883 is used to report the acquisition or disposition of stock in a target corporation under section 338 of the internal revenue code.