Form K1

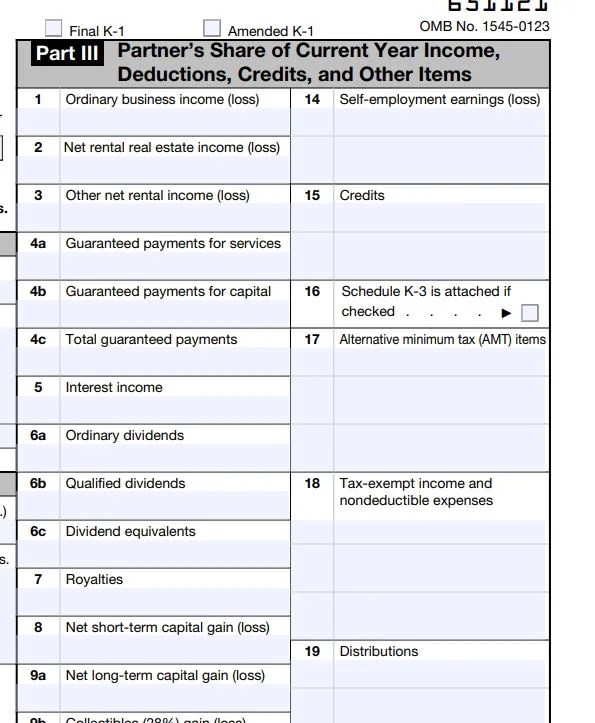

Form K1 - Web this is an early release draft of an irs tax form, instructions, or publication, which the irs is providing for your information. Web this is the official pdf document of the irs form for reporting partner's share of income, deductions, credits, etc. It includes codes, instructions, and. Web this is a pdf form for reporting the beneficiary's share of income, deductions, credits, and other items from an estate or trust for tax year 2023. Learn how to complete part i (partner basis), part ii. Partner's share of income, deductions, credits, etc.

Keep it for your records. Partner's share of income, deductions, credits, etc. For calendar year 2020 or tax year beginning or ending in 2020. Do not file draft forms and do not rely on. Learn how to complete part i (partner basis), part ii.

Learn how to complete part i (partner basis), part ii. Web this is an early release draft of an irs tax form, instructions, or publication, which the irs is providing for your information. Web this is the official pdf document of the irs form for reporting partner's share of income, deductions, credits, etc. Keep it for your records. It includes codes, instructions, and.

It includes codes, instructions, and. Web this is an early release draft of an irs tax form, instructions, or publication, which the irs is providing for your information. For calendar year 2020 or tax year beginning or ending in 2020. Keep it for your records. Learn how to complete part i (partner basis), part ii.

For calendar year 2020 or tax year beginning or ending in 2020. Web this is the official pdf document of the irs form for reporting partner's share of income, deductions, credits, etc. Web this is a pdf form for reporting the beneficiary's share of income, deductions, credits, and other items from an estate or trust for tax year 2023. Web.

Partner's share of income, deductions, credits, etc. Do not file draft forms and do not rely on. It includes codes, instructions, and. Similar to a 1099 form received. Web this is a pdf form for reporting the beneficiary's share of income, deductions, credits, and other items from an estate or trust for tax year 2023.

For calendar year 2020 or tax year beginning or ending in 2020. It includes codes, instructions, and. Do not file draft forms and do not rely on. Web this is the official pdf document of the irs form for reporting partner's share of income, deductions, credits, etc. Keep it for your records.

Do not file draft forms and do not rely on. Similar to a 1099 form received. Web this is the official pdf document of the irs form for reporting partner's share of income, deductions, credits, etc. Web this is a pdf form for reporting the beneficiary's share of income, deductions, credits, and other items from an estate or trust for.

Form K1 - Web this is a pdf form for reporting the beneficiary's share of income, deductions, credits, and other items from an estate or trust for tax year 2023. Partner's share of income, deductions, credits, etc. Similar to a 1099 form received. It includes codes, instructions, and. Learn how to complete part i (partner basis), part ii. For calendar year 2020 or tax year beginning or ending in 2020. Keep it for your records. Web this is an early release draft of an irs tax form, instructions, or publication, which the irs is providing for your information. Web this is the official pdf document of the irs form for reporting partner's share of income, deductions, credits, etc. Do not file draft forms and do not rely on.

It includes codes, instructions, and. Web this is an early release draft of an irs tax form, instructions, or publication, which the irs is providing for your information. For calendar year 2020 or tax year beginning or ending in 2020. Web this is the official pdf document of the irs form for reporting partner's share of income, deductions, credits, etc. Do not file draft forms and do not rely on.

Partner's share of income, deductions, credits, etc. Do not file draft forms and do not rely on. Web this is the official pdf document of the irs form for reporting partner's share of income, deductions, credits, etc. For calendar year 2020 or tax year beginning or ending in 2020.

Learn how to complete part i (partner basis), part ii. Web this is the official pdf document of the irs form for reporting partner's share of income, deductions, credits, etc. Web this is a pdf form for reporting the beneficiary's share of income, deductions, credits, and other items from an estate or trust for tax year 2023.

Web this is the official pdf document of the irs form for reporting partner's share of income, deductions, credits, etc. Keep it for your records. Do not file draft forms and do not rely on.

Learn How To Complete Part I (Partner Basis), Part Ii.

For calendar year 2020 or tax year beginning or ending in 2020. Keep it for your records. Do not file draft forms and do not rely on. Partner's share of income, deductions, credits, etc.

Web This Is The Official Pdf Document Of The Irs Form For Reporting Partner's Share Of Income, Deductions, Credits, Etc.

Web this is an early release draft of an irs tax form, instructions, or publication, which the irs is providing for your information. Similar to a 1099 form received. Web this is a pdf form for reporting the beneficiary's share of income, deductions, credits, and other items from an estate or trust for tax year 2023. It includes codes, instructions, and.

:max_bytes(150000):strip_icc()/ScheduleK-1-PartnersShareofIncomeetc.-1-134752a3fa884035822acd99c23703e0.png)