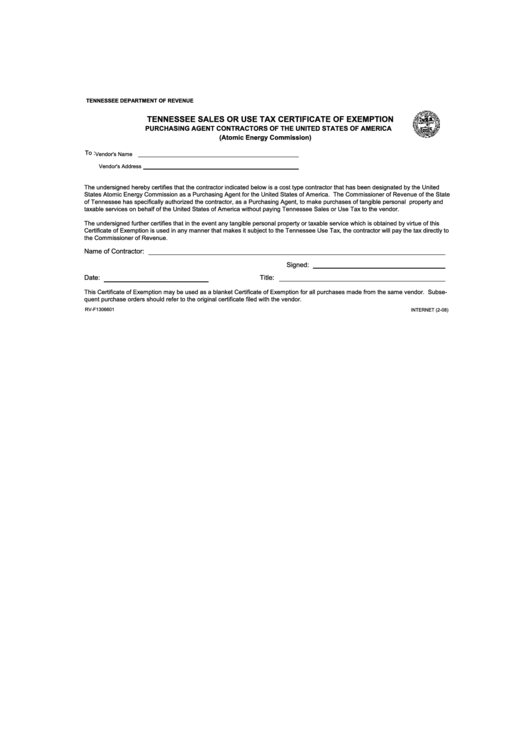

Tn Resale Certificate Form

Tn Resale Certificate Form - If you don’t have this document, you can contact the. This verification does not relieve the vendor of. Web exemptions, certificates and credits. Web you likely received a tennessee resale certificate when you registered for your tennessee sales tax permit. Web all tennessee sales and use tax exemption certificates, including resale certificates, can be verified on the department’s website. All sales and use tax returns and associated payments must be submitted electronically.

This verification does not relieve the vendor of. A taxpayer can access its resale certificate by submitting a request through the tennessee. Sales and use tax, television and. Web all tennessee sales and use tax exemption certificates, including resale certificates, can be verified on the department’s website. All sales and use tax returns and associated payments must be submitted electronically.

Sales and use tax, television and. Web the first step you need to take in order to get a resale certificate, is to apply for a tennessee sales tax number. Web find and fill out the correct tennessee resale certificate pdf. All sales and use tax returns and associated payments must be submitted electronically. A taxpayer can access its resale certificate by submitting a request through the tennessee.

Web find and fill out the correct tennessee resale certificate pdf. This verification does not relieve the vendor of. Web sales and use tax certificates can be verified using the tennessee taxpayer access point (tntap) under information and inquiries. Web application for sales and use tax exempt entities or state and federally chartered credit unions. The seller did not fraudulently.

Choose the correct version of the. All sales and use tax returns and associated payments must be submitted electronically. We have simplified the process to save you time using the following steps: Web all tennessee sales and use tax exemption certificates, including resale certificates, can be verified on the department’s website. Web any merchandise obtained upon this resale certificate is.

Web exemptions, certificates and credits. Application for registration agricultural sales and use tax. Web a business registered for sales and use tax may use a resale certificate only when purchasing merchandise that will be resold by the business. Web up to 3% cash back any merchandise obtained upon this resale certificate is subject to the sales and use tax if.

Web all tennessee sales and use tax exemption certificates, including resale certificates, can be verified on the department’s website. We have simplified the process to save you time using the following steps: A taxpayer can access its resale certificate by submitting a request through the tennessee. The seller did not fraudulently fail to. There is an exemption available to farmers,.

A taxpayer can access its resale certificate by submitting a request through the tennessee. Web you likely received a tennessee resale certificate when you registered for your tennessee sales tax permit. Web all tennessee sales and use tax exemption certificates, including resale certificates, can be verified on the department’s website. Web when you register for a tennessee sales and use.

Tn Resale Certificate Form - Web sales and use tax certificates can be verified using the tennessee taxpayer access point (tntap) under information and inquiries. In order to do so, the retailer will first. Web find and fill out the correct tennessee resale certificate pdf. Web all tennessee sales and use tax exemption certificates, including resale certificates, can be verified on the department’s website. Web exemptions, certificates and credits. Web the first step you need to take in order to get a resale certificate, is to apply for a tennessee sales tax number. Web application for sales and use tax exempt entities or state and federally chartered credit unions. Web purchasers must provide a new resale or exemption certificate if there are changes in the purchaser's business (e.g., change in ownership or address), the. Web up to 3% cash back any merchandise obtained upon this resale certificate is subject to the sales and use tax if it is used or consumed by the purchaser in any manner and must be. This verification does not relieve the vendor of.

We have simplified the process to save you time using the following steps: Sales and use tax, television and. There is an exemption available to farmers, timber harvesters, nursery operators, and dealers. Web sales and use tax certificates can be verified using the tennessee taxpayer access point (tntap) under information and inquiries. Web purchasers must provide a new resale or exemption certificate if there are changes in the purchaser's business (e.g., change in ownership or address), the.

Sales made to vendors or other establishments for resale, and sales of items to be used in processing articles for sale. Web all tennessee sales and use tax exemption certificates, including resale certificates, can be verified on the department’s website. Web you likely received a tennessee resale certificate when you registered for your tennessee sales tax permit. Sales and use tax, television and.

Web sales and use tax certificates can be verified using the tennessee taxpayer access point (tntap) under information and inquiries. Sales and use tax, television and. Web application for sales and use tax exempt entities or state and federally chartered credit unions.

Web you likely received a tennessee resale certificate when you registered for your tennessee sales tax permit. Web the fully completed exemption certificate is provided to the seller at the time of sale or within 90 days subsequent to the date of sale; The seller did not fraudulently fail to.

If You Don’t Have This Document, You Can Contact The.

Web application for sales and use tax exempt entities or state and federally chartered credit unions. Web a business registered for sales and use tax may use a resale certificate only when purchasing merchandise that will be resold by the business. Web registration, filing and payment using tntap. Web find and fill out the correct tennessee resale certificate pdf.

Web All Tennessee Sales And Use Tax Exemption Certificates, Including Resale Certificates, Can Be Verified On The Department’s Website.

Web the easiest way to apply for a resale certificate in tennessee is to use fastfilings. Choose the correct version of the. Sales and use tax, television and. All sales and use tax returns and associated payments must be submitted electronically.

Web A Tennessee Resale Certificate Allows A Business In Tennessee To Purchase Items For Resale Without Paying Sales Tax.

Once you have that, you are eligible to issue a resale. A taxpayer can access its resale certificate by submitting a request through the tennessee. There is an exemption available to farmers, timber harvesters, nursery operators, and dealers. Web sales and use tax certificates can be verified using the tennessee taxpayer access point (tntap) under information and inquiries.

Web The First Step You Need To Take In Order To Get A Resale Certificate, Is To Apply For A Tennessee Sales Tax Number.

Web any merchandise obtained upon this resale certificate is subject to the sales and use tax if it is used or consumed by the vendee in any manner and must be reported and the tax. Web exemptions, certificates and credits. Web purchasers must provide a new resale or exemption certificate if there are changes in the purchaser's business (e.g., change in ownership or address), the. The seller did not fraudulently fail to.